TikTok Shop has quickly established itself as a key player in Malaysia’s e-commerce landscape. With its seamless integration of content and commerce, the platform presents a critical question for brands: Should they look beyond engagement to unlock its full potential for driving conversions? How does it measure up to platforms like Instagram Shop, or the heavyweights in e-commerce, Shopee and Lazada?

TikTok Shop has created an ecosystem where the journey from content discovery to purchase is effortless. Through in-feed videos, live streaming, and the Shop Tab, customers can explore products and make purchases without leaving the app. Features like the “Yellow Shopping Bag” and integrated product links transform engaging content into actionable sales opportunities.

What sets TikTok Shop apart is its ability to blur the lines between entertainment and e-commerce. Instead of being a platform solely for brand awareness, TikTok Shop empowers businesses to drive direct conversions by connecting directly with highly engaged users at the point of purchase—making it an untapped opportunity for those yet to fully embrace its potential.

Instagram Shop

While TikTok predominantly appeals to Gen Z, Instagram attracts a broader demographic with a focus on aesthetic visuals and curated content. While its shoppable features lack the interactivity of TikTok’s immersive live streams. Instagram still plays a critical role in driving brand awareness, engagement, and traffic to websites or other platforms for conversions. However, the removal of shop features from Meta platforms in Malaysia—including product tagging in posts, Reels and Stories—has given TikTok Shop an advantage in dominating the social commerce market.

Shopee and Lazada

These platforms dominate Malaysia’s e-commerce space, especially for middle and bottom-of-the-funnel transactions, with their extensive product catalogues and robust payment systems. However, TikTok Shop’s integration of entertaining content and commerce offers a unique edge in creating a seamless path to purchase. A 2023 survey on e-commerce consumer behaviour in Malaysia showed 78% of respondents favoured Shopee for online shopping, followed by TikTok Shop at 35%. This highlights TikTok Shop’s growing popularity as a social commerce platform and its potential to compete with the dominant e-commerce players.

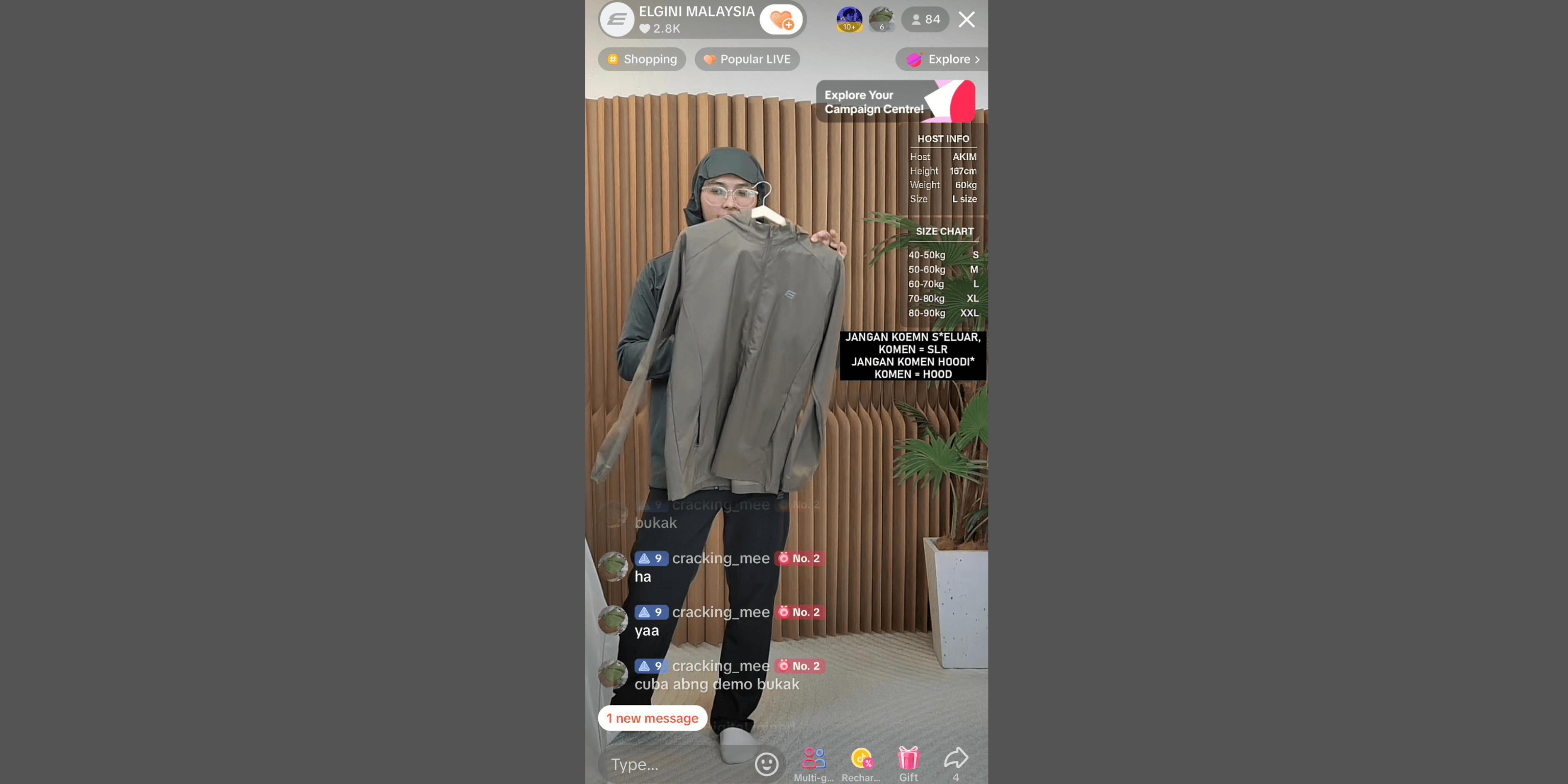

ELGINI

This Malaysian fashion brand leveraged TikTok Shop’s live streaming features to turn casual viewers into loyal customers. Hosting multiple live sessions daily, ELGINI grew its follower base to 700,000 and significantly increased revenue.

Source: Mighty White

Mighty White

Having only joined TikTok Shop in early 2024, Mighty White achieved 623% Gross Market Value (GMV) growth during its recent 11.11 campaign via TikTok Shop, proving the platform’s effectiveness at driving sales.

Source: Zucca Butik

Zucca

During TikTok Shop’s 3.3 campaign, local modest fashion company Zucca sold over 20,000 clothing items in a single live session, generating RM320,000 in revenue. The results highlight TikTok’s potential for high-volume sales in short time frames.

A big fat YES!

TikTok’s investments in live shopping and its regional growth in Southeast Asia signal immense potential for local brands. Aftership reports that Malaysia is one of TikTok Shop’s top-performing markets, contributing a staggering $1.63 billion GMV—nearly half of the platform’s global GMV in Southeast Asia.

As the platform continues to grow, it becomes clear that the TikTok is not just about engagement or viral trends. It offers a dynamic, content-driven e-commerce environment that allows brands to convert engagement into direct sales. For Malaysian brands, the question isn't whether to use TikTok Shop; it’s how to strategically unlock its potential and position themselves ahead of competitors in the evolving e-commerce landscape.

March 21, 2024

March 29, 2024

June 19, 2024